Welcome to my first post! I created this space to share my thoughts on amazing companies and their fascinating histories. As I approach a decade of working in Finance, I have consistently come across a lot of information that I am impressed by – so why keep it to myself?

My objective is to share these insights – in a simple way, so that everyone can learn something new and inspiring at each post! Important: This is not investment advice.

Kicking things off, I was inspired by the Paris Haute Couture Week and decided to start with the biggest luxury conglomerate in the world: LVMH. For those unfamiliar, LVMH is the conglomerate behind 75 brands (referred to as maisons), including Louis Vuitton, Christian Dior, and Moët & Chandon.

My interest in the company began a few years ago when its CEO, Bernard Arnault, was named the world’s richest person (yes, surpassing Elon Musk and Jeff Bezos). I was shocked when I saw the news on my Bloomberg terminal, and since then, I started think about some of the questions below:

How did this happen? Honestly, I never realized how profitable the luxury industry could be.

How does a luxury conglomerate work and why is it a good business? What are its advantages?

How did he create this empire only by way of acquisitions (he wasn’t the founder of any brand)?

What is next for the company? What can I be curious to look forward to?

I will answer these questions, dive into some corporate drama, and show you how impressive this company is. I hope you enjoy it!

Entering Fashion:

Bernard Arnault attended the École Polytechnique and earned a degree in engineering. After graduating, he joined his family’s construction firm, which did well for the time. However, with the socialists rising to power in France in the 80s, Arnault moved his family to the US and shifted the company’s focus to develop real estate condos (here, he learns how Americans do business, which will be important later on).

As Arnault said in an interview at Oxford University, his idea to go into fashion came up in a conversation with a taxi driver in New York. When asked if he knew France’s president at the time (which was Georges Pompidou), the driver said, “No, but I know Christian Dior.” This comment stuck in his mind and sparked the vision of what would later become LVMH.

In 1984, an opportunity arose: the French government was looking for a buyer for the bankrupt textile group Boussac Saint-Frères. The group, which made disposable diapers, also owned Christian Dior. Arnault, gathered with the investment bank Lazard, bought the company for $60 million - $15 million by Arnault and the rest by Lazard.

After that, he restructured the company by firing 9,000 employees and selling all the assets except Christian Dior and the department store Le Bon Marché. He was criticized by the French media – earning the nickname “the Terminator” – but he only applied what he learned while working in America.

Acquiring LVMH:

Since buying Dior, Arnault had the vision of building a luxury conglomerate. That initial move into Dior set the tone for his next big goal: building an empire of luxury brands. And that's where LVMH comes into play. As his son Alexandre explained in an interview with Oxford University (worth watching):

“There are a lot of synergies that could be built between brands (…) For creativity is amazing because having a conglomerate allows people to go from one brand to another and across different industries”.

LVMH believes that the brands should be independent, but benefit from synergies such as economies of scale, talent development, advertising, and the rental of multiple store locations with greater negotiating power.

With that, his next step into building a luxury conglomerate started when a fight between the leaders of Louis Vuitton and Moët Hennessy began (the companies merged in 1987 creating LVMH). In summary, he bought public shares of the company, got rid of both leaders (Henri Racamier and Alain Chevalier), and got himself elected as CEO in 1989. Ever since he has led the group through multiple acquisitions with a mission to “make LVMH the world leader in luxury”.

By this point, we understand Arnault’s strategy: buying public shares and kicking everyone out. Although the group succeeded in most of its attempts, it failed in two remarkable situations – the attempt to buy Gucci and Hermès.

LVMH vs. Gucci

Before we start, I have to say that this is one of the most interesting corporate battles in the luxury world. There is drama, loopholes, new names, and, most important, an unexpected outcome.

In the late 80s, the Gucci family sold the company to the private equity firm Investcorp. Back then, Gucci was struggling and almost went bankrupt. Consequently, in 1994, Bernard Arnault agreed that he would buy Gucci from Investcorp for $400 million. This would have been perfect for the parties involved – LVMH would have added Gucci to its portfolio, and Investcorp would have doubled its investment of $200 million and got rid of the unprofitable business.

However, once Arnault started doing the due diligence, he decided to back out of the deal, claiming that Gucci was worthless. This led Investcorp to change management to revive the business. They decided to bring Domenico De Sole as CEO and Tom Ford as creative director. After Ford’s first collection, Gucci instantly returned to profitability and doubled its sales. The revival of the brand was so successful that Investcorp did an IPO in 1995 on the New York Stock Exchange (NYSE).

With Gucci now public, LVMH started to attempt a takeover. Arnault began quietly acquiring shares (these purchases were traced to a phantom corporation that had LVMH's Paris address), accumulating a stake of 34.4%. According to him, the intention wasn’t to launch a hostile takeover but to prevent other investors, like Prada, from stepping in. In the end, he wanted board seats and, eventually, to add the company to LVMH’s portfolio.

De Sole finds out and tries to find someone (aka in finance, a white knight) to counter LVMH’s control. He received refusals and, curiously, whenever De Sole advanced in finding a partner, Arnault bought more shares in the public market – it seemed like everyone was loyal to LVMH. Then, a solution appeared: Gucci’s lawyers suggested the creation of an Employee Stock Ownership Plan (ESOP). This would dilute LVMH’s participation in the company by issuing shares to employees.

Gucci proceeded to create the ESOP, and LVMH believed this maneuver was illegal under NYSE rules, which require shareholder approval for transactions exceeding 20% of a company’s capital. However, because Gucci was incorporated in the Netherlands, this restriction did not apply. LVMH sued Gucci in Dutch court but lost. Gucci also got their white knight, François Pinault (of Kering), ending the battle. As part of the agreement, the ESOP was canceled, and both Domenico De Sole and Tom Ford remained in leadership. A final deal was struck with LVMH, which agreed to sell its Gucci shares in two tranches, ultimately walking away with a €760 million profit.

If you are interested in more details, I highly recommend reading Vanity Fair’s article called “Gucci and Goliath”.

LVMH vs. Hermès:

Over the next decade, LVMH started secretly (again!) accumulating a stake in Hermès, by using equity swaps. When the families that controlled Hermès found out, they went to court. The French financial authority fined LVMH for not properly disclosing its shareholding, and that forced LVMH to reduce its stake and prohibited further acquisitions for five years. LVMH made billions from selling the shares and retained only 8.5% of Hermès – not enough to take control.

LVMH vs. Tiffany’s:

The latest controversial acquisition that the group was involved in was Tiffany & Co. Arnault made an offer of $16.2 billion to buy the company in 2019 but tried to back out of the deal when Covid hit. Long story short: Tiffany sued LVMH, LVMH countersued Tiffany, and even the French foreign minister got involved, stating that this would interfere in the trade between the US and France. Eventually, LVMH buys Tiffany & Co for $15.8 billion – guaranteeing a discount of $425 million from the original price.

Since then, his son Alexandre was named Executive Vice President and has played a key role in modernizing the business. He put out collaborations and marketing campaigns, such as the one featuring Beyoncé and Jay-Z, along with the controversial campaign “Not your mother’s Tiffany”. Regarding the latter, Alexandre said that mothers want to look like their daughters. LVMH invested $350 million to renew the flagship store in NYC (on 57th Street and Fifth Avenue) and just announced that the store “achieved record-breaking revenue in 2024”.

The House of Arnault:

LVMH is thriving. In 1987 the group had 10 maisons, 12,000 employees, and sales of €3 billion. Now, with a revenue of €84.7 billion, 75 maisons, and more than 215,000 employees worldwide (as of year-end 2024), it is France’s largest private-sector recruiter. Bernard Arnault is one of the wealthiest people in the world – according to the Bloomberg Billionaires Index – and LVMH achieved the status of one of the biggest companies by market capitalization. The control is still with the Arnault family’s hands: they own 49% of LVMH shares and approximately 65% of the voting rights (as of year-end 2024).

The Arnault family’s influence isn’t just financial—it’s personal. With all five children involved in the company, Bernard Arnault has carefully set up a structure that ensures the future leadership of LVMH remains in the family’s hands.

That usually leads to the question: What about succession? If you search for this topic, you will see tons of articles reporting this matter; all 5 of Bernard Arnault’s children are executives in the family business. Although he is not planning to retire any time soon (he recently increased the age limit to remain CEO), he planned well: the 5 children have an equal share in the holding company (Agache Commandité), cannot sell the shares for 30 years, and can’t unilaterally pass any strategic decisions. The way this is structured tells us that Arnault is setting a peaceful environment among his successors – a point of failure for many family businesses.

But if I had to choose one of his children as his successor, I would pick Alexandre. Why?

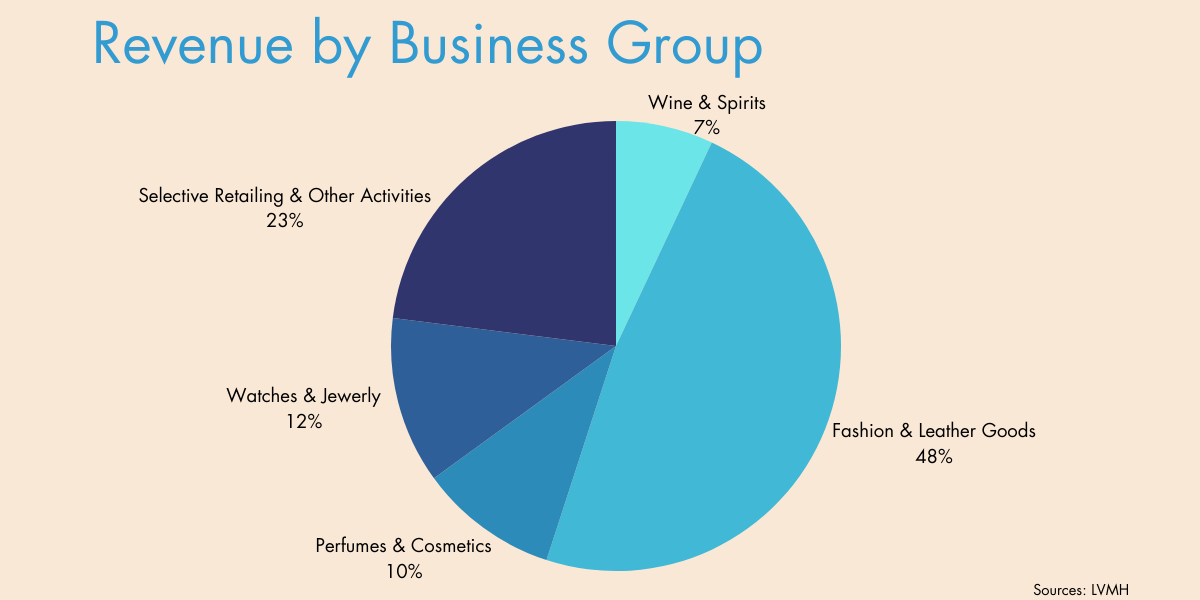

Alexandre has proved himself to be forward-facing and visionary. That is what he did with Tiffany (including its aforementioned marketing campaign) and Rimowa. Regarding the latter, he presented the deal to LVMH, and once it got approved, the Rimowa family told him they would only sell to LVMH if he became co-CEO – and that is how he earned the position. While at Rimowa, he made remarkable collaborations, such as the one with Supreme, and put the brand on the radar of the younger generation. Now, I am excited to see what he will do in the Wine & Spirits division – he, along with the group CFO, Jean-Jacques Guiony, is taking over this segment. The revenue for Wines and Spirits decreased by 11% in 2024 because of the impact of exchange rates and the continuation of the demand normalization.

As I am talking about the numbers for 2024, it is worth highlighting that although the conglomerate only publishes global numbers, there were brands that “achieved outstanding results” in the year: Loewe, Loro Piana, Rimowa, Bulgari, Tiffany & Co., and Sephora. According to the earnings report, “Sephora achieved another remarkable year, with double-digit growth in both revenue and profit, continuing to gain market share.”

I am sure that the Arnault family is not done expanding their luxury conglomerate. Besides having a lot of potential brands that I see could easily and synergistically become part of the group (Armani, Patek Philippe, Audemars Piguet, etc.), I noticed the following in the latest earnings report:

“In September 2024, LVMH and Remo Ruffini – Chairman and CEO of Moncler – entered into an investment agreement under which LVMH plans to acquire, over a period of 19 months, up to 22% of the share capital and voting rights in Double R, the holding company that controls Moncler, owned by Mr. Ruffini. Double R will hold up to an 18.50% stake in Moncler.”

The stage is set one more time.

Other Activities:

I would like to wrap up by talking about two segments I believe we will hear more about in the next few years: Luxury Traveling and Real Estate. As of now, there isn’t a lot of available information regarding the performance of these activities, since they both are under the segment “Other Activities”. However, I would say they are related (luxury hotels are in prime real estate locations) and have a few characteristics in common: high initial investment and long-term time horizons before we start seeing the results.

Recent accomplishments in travel include the acquisition of the hotel chain Belmond (in 2019), the opening of Cheval Blanc in the Seychelles, and the announcement of a partnership with Accor to develop Orient Express.

The group has also been trying to increase its presence in the real estate segment through Bernard Arnault’s private equity firm, L Catterton. One of its most well-known projects is Miami’s Design District, where an industrial area was transformed into pure luxury. This development changed consumer behavior, creating another luxury hub to compete with Bal Harbour. Arnault even closed the Louis Vuitton store from Bal Harbour to reopen on his development. His most recent project, Royalmount, is a luxury shopping center in Montreal that opened in 2024.

As expected, Arnault decides which tenants can occupy his properties. Thus, when there is a competitor in a prime location, they are asked to move out once the lease expires. This unleashes another way for LVMH to solidify its presence - no sign of stopping. According to Bloomberg, “in 2024 alone, LVMH spent a record €2.45 billion on real estate acquisitions.” That gives Arnault two sources of income – store sales and leasing space – plus the appreciation of the property.

LVMH’s success is no accident, driven by strategic acquisitions, bold leadership, and a keen eye for luxury markets. It’s a story of vision, persistence, and the art of creating value.

Disclaimer: The information shared in this post is for informational purposes only and does not constitute investment advice. Please do your research or consult a professional before making any financial decisions. I may hold shares in the companies I discuss.

Sources:

The Perfect Paradox of Star Brands: An Interview with Bernard Arnault of LVMH

Why luxury groups have become real estate developers – CPP-LUXURY

LVMH achieves a solid performance despite an unfav... - LVMH

LVMH and Accor join forces to take Orient Express ... - LVMH

Acquired Podcast

https://www.nytimes.com/1989/12/17/magazine/a-luxury-fight-to-the-finish.html

Cheval Blanc opens sixth Maisons in the Seychelles... - LVMH

https://hauteliving.com/2023/04/tiffany-and-co-the-landmark-soiree/729464/

https://press.tiffany.com/tiffany-co-introduces-the-about-love-campaign-starring-beyonce-and-jay-z/

https://www.wallpaper.com/fashion/louis-vuitton-new-bond-street-store-opening